The Village Bank is a community-based financial institution that prides itself on providing personalized banking experiences. Customers value community-driven service, but they also expect the latest in digital banking tools. We were tasked with helping the bank stand out in a market increasingly dominated by larger, tech-driven banks.

Percentage of banking consumers in the U.S. that switched banks in the previous year, with one of the greatest reasons being the need for improved digital experiences and more personalized services.

Smaller community banks are often perceived as lagging behind when it came to digital services and technological innovation. The goal was to craft visual messaging around a new account product the bank wanted to promote. It was important to dispel any doubts that community banks couldn’t keep up with the bigger players. The Village Bank provides modern, reward-driven banking experiences and wanted to develop a compelling, modern campaign to communicate these values and engage their customers in a meaningful way.

I developed a mood board to explore the different visual styles that could effectively convey the essence of the financial institution’s modern, digital-forward offering. It was important for the campaign to be modern, straightforward, and innovative. A tech-driven, digital landscape aesthetic to evoke a seamless the modern banking experience was the direction we felt worked perfectly. The result was a series of sleek, digital typographic designs paired with a stock video that I customized, edited and aligned with the bank’s branding.

One of the campaign’s standout elements was a motion graphic I created, which introduced the campaign tagline “Banking so rewarding, it pays you.” with a transtion to the account name “eVolve” (not a typo). I used clever typographic twist to transform the campaign’s name, “eVolve” into “love,” with the bank’s logo incorporated as the “o” in “love”, with “your bank” animating in underneath. The video became the centerpiece of the campaign, serving as the central frame to communicate the digital features of the account.

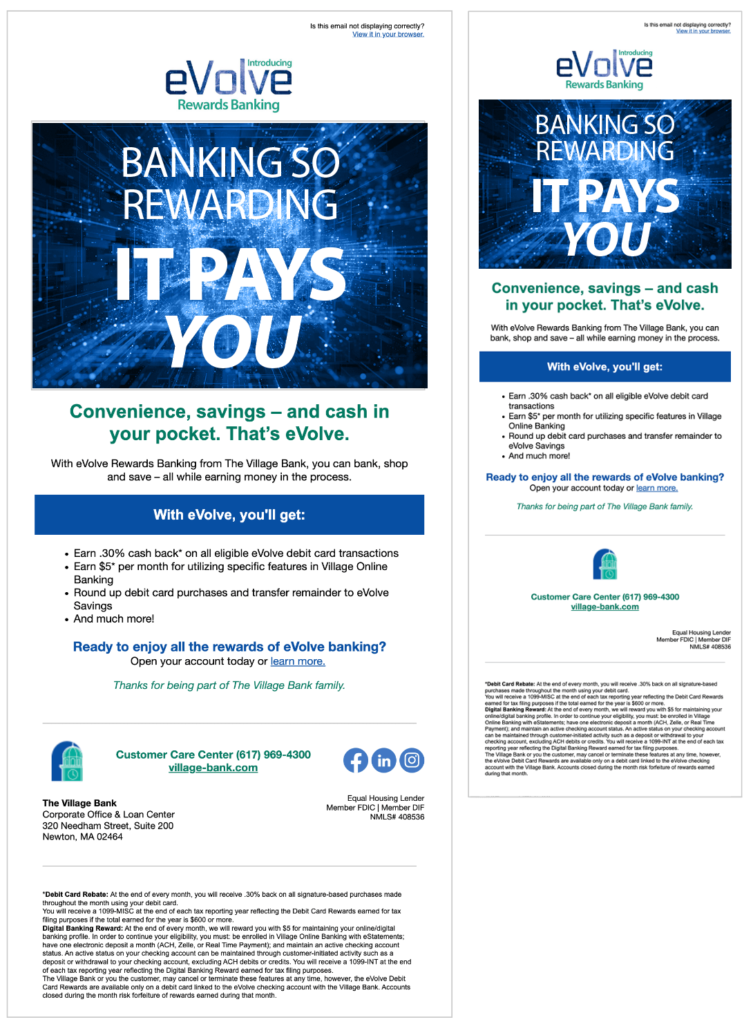

We rolled the campaign across multiple channels. I led creative execution on treatments for social media, email marketing, digital ads, landing pages, and large window displays at their branches. To ensure we reached both existing customers and new prospects, we used targeted ads.

At the heart of this mission was to promote a deposit account that combined reliability with innovative features designed for today’s tech-savvy consumers. Offering cash-back rewards was a highlight for customers who engaged with their digital features, such as a $5 credit for enrolling in e-statements, .30% cash-back by shopping with your debit card, and automatic round-up savings.

The campaign visuals were featured across all touchpoints, ensuring consistency in messaging and visual impact. We also created various subsequent complementary promotional materials over the course of the year to maintain engagement with customers and keep the momentum going.

The impact of this campaign was significant for The Village Bank. Over the course of the year, 95% of existing customers opted into the new digital features of the deposit account, generating an average of $33 per account in additional monthly rewards. In addition, our subsequent promotional push saw 60 new accounts opened in just 10 days, which was a direct result of the excitement around the digital cash-back rewards offer.

The campaign contributed to an overall $140 million increase in deposits in 2022. More impressively, when looking at the last few years (which have been difficult for the financial services industry) it served as instrumental in the bank’s increase of its market share in Newton, MA by 9% for deposits between 2019 and 2024, while its largest competitors (including Bank of America, and Citizen’s Bank) saw negative growth in the same period.

In an era when more customers are seeking better digital experiences, The Village Bank’s ability to maintain its community-focused values while offering cutting-edge services truly set it apart.

Over the course of the year, many existing customers opted into the new digital features of the deposit account. In addition, our subsequent promotional push saw 60 new accounts opened in just 10 days, which was a direct result of the excitement around the digital cash-back rewards offer.

The campaign contributed to substantial increased deposits. More impressively, when looking at the last few years (which have been difficult for the financial services industry) it served instrumental in the bank beating other larger banking institutions in deposit market share.

In an era when more customers are seeking better digital experiences, The Village Bank’s ability to maintain its community-focused values while offering cutting-edge services truly set it apart.